Kyle's Blog

When Should I Sell My Bitcoin?

Use The Rake Method. A Sane, Simple Savings Plan For Bitcoin.

Why Bitcoin?

1. Bitcoin made me rich. But consider the guy who sold the two pizzas to Laszlo Hanyecz for 10,000 BTC (~$0.0025/BTC). If the seller waited just 4 years a $25 investment would have turned into $10 million — a nice 500,000 x reward. But what if he would have excitedly sold it all (he did) when the price first doubled? Then instead of millions, he would have netted $25. So, how do we know when to sell our Bitcoin?

2. It is actual money that you lose if you do not buy, or buy a smaller amount than you could have bought. My friends, family and I would all be dollar millionaires by now, had we just acted rationally since the day we first heard about Bitcoin. Even I would probably have 10x more coins with no corresponding increase in risk had I followed this method from day 1.

3. Bitcoin is a disruptive technology that has the potential to change the world even more than the Internet has done. If this happens, the inbuilt dynamics make it happen relatively soon (by the end of the 2020's at most). In this scenario even the 500,000x price increase (to $1,000) since “the pizza” will probably be the low-water mark for Bitcoin.

B) Gold-Level Market Cap

A gold-like marketcap would translate to $300,000 per Bitcoin. That would be a mere 300x increase from current levels. Considering that 12-months trailing average shows almost 100x, this could conservatively be achieved in 2016, realistically in 2015 and possibly in 2014. A longer-term trendline analysis extrapolated, shows 8/2016.

But going even further, comparing Bitcoin to gold (borrowing the analogy from Zangelbert), would be akin to comparing email to postal letters. The new technology not only effectively replaces the old, but also brings so many other benefits that you cannot imagine them before seeing. In email’s case, you could for example link all information in the world to your post, it would reach the recipient instantly, and not cost anything. Bitcoin does the same to something that is way bigger than the industry of delivering mail — the monetary system. A comparison to gold is probably not at all enough. The comparison to all dollars, all fiat currencies, or all liquid financial instruments may still be an underestimate. On the other hand, if something so good happens to the debt-ridden world, even those who did not buy any bitcoins, are mostly better off.

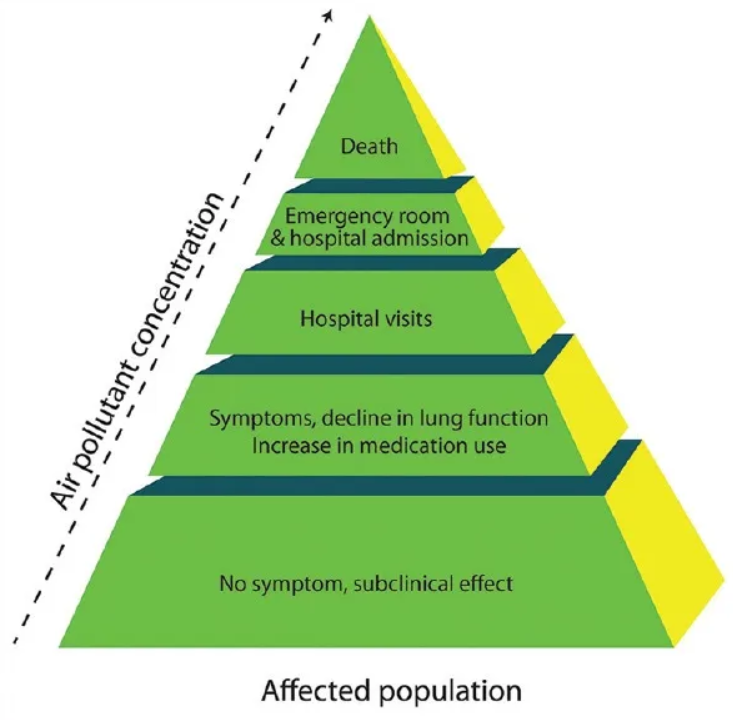

The Pyramid of Death

Then there is the flipside of the coin: the disruptive technology is still on beta. So far all is fine, but nobody gives any guarantees. Despite that by reading about Bitcoin you gain more confidence towards it in all levels, there still are many known threats and dangers, technical and political, and sometimes also unknown things happen. Unbelievably few understand bitcoin even now. It is an unknown thing to them. To keep things simple, we postulate that Bitcoin is in a constant danger of self-annihilating, and its exchange value going to zero. This is not necessary the most realistic negative option, but serves as a good counterweight to the mind-blowing positive case.

The Rake, or SSS System for Investing Bitcoin

The odds are so much on your side that there is no reason to take any risks. If it goes up, any number of bitcoins makes you rich, and even if you have zero, you will still be richer than before Bitcoin (I do not own any shares of Facebook, but acknowledge its importance and the benefits that I get for free). If it goes down, you should only lose slack money, money that you did not need anyway. You cannot lose more than you put in, so don’t put in more than you can afford to lose and you’ll be all right, even in the most negative case.

First you need to find out how much you have. To keep keeping

things simple, take first aside all the things that you need.

They are not counted. Then calculate the resale value of the

rest of your things, subtract all debts, and you find your

financial net worth. Since house is so big, you should count

house equity toward the total, but if you prefer thinking it as

separate, you can also decide that you ‘need’ it and not count

it. In this case, do not subtract the mortgage either.

Then you select the rake. You know the concept from poker

establishments: some percent of all winnings goes to the house.

With bitcoin we except great gains, so we want to ‘tax’ them to

increase our living standard, or just to keep some diversified

in case the negative event happens and bitcoins lose their

value. The rake is the percentage to set aside, every time that

the price doubles. If for example you select 10%, this will lead

that 20% of your portfolio is in non-bitcoins and 80% in

bitcoins. If you select 20%, the result is 40% in bitcoins/60%

non-bitcoins.

For most of us, the previous percents sound extreme. But they

are my recommendations. Remember, you do not need to invest more

than you can afford to lose. In purist case, selecting a 10%

rake would require you to invest 80% of your liquid wealth in

bitcoins. But if that does not feel comfortable, you can invest

10% instead. In this case you can boost the accumulation by not

raking your pot in the first doublings, only after it has

increased to your target of 80% of your financial net worth.

The price now is about $1 per mBTC. (It is very much likely that

we will spontaneously revert to mBTC when the average investment

is no more even one bitcoin. So let’s start it now.) First

doubling is at $2, then at $4, $8, $16, $32, $64, $125, $250,

$500 and $1000. So there are 10 doublings in total, which take

the price up 1,000x. In the end, one bitcoin is worth $1

million, and one dollar is worth quite much less than it is now.

The plan ends there because the world will look very much

different. Before that, you stick to the plan: if it goes to

zero, you net a small gain or a small loss.

Let’s take an example of a person who only now finds bitcoin,

has $50k in liquid assets, but is unwilling to risk more than

$10k. His rake level is 10%, which starts immediately.

Code:

Price

mB

k$ mB

Other Total BTC%

left sold out

val. val. value

2 9000

1000 2

18

42

60 30 %

4 8100

900 4

32

46

78 42 %

8 7290

810 6

58

52

110 53 %

16 6561

729 12

105 64

169 62 %

32 5905

656 21

189 85

274 69 %

64 5314

590 38

340 123

463 74 %

125 4783

531 66

598 189

787 76 %

250 4305

478 120

1076 309

1385 78 %

500 3874

430 215

1937 524

2461 79 %

1000 3487

387 387

3487 911

4398 79 %

The important parameters are:

- Purchased 10,000mBTC, in the end he still has 3,487mBTC.

- Recovered initial investment of $10k in full when mBTC hits

$8.

- In the end his fiat+other stuff stash is worth $0.9 million.

left sold out val. val. value

2 9000 1000 2 18 42 60 30 %

4 8100 900 4 32 46 78 42 %

8 7290 810 6 58 52 110 53 %

16 6561 729 12 105 64 169 62 %

32 5905 656 21 189 85 274 69 %

64 5314 590 38 340 123 463 74 %

125 4783 531 66 598 189 787 76 %

250 4305 478 120 1076 309 1385 78 %

500 3874 430 215 1937 524 2461 79 %

1000 3487 387 387 3487 911 4398 79 %

Discussion:

It is important to buy in as soon as possible, because waiting has in general not been a good strategy with bitcoin. Even if price drops afterwards, you should not feel any remorse at all — we are counting towards $1 million or nothing. If ‘nothing’ happens, you lose as many dollars, regardless of purchase price. If $1 million happens, then yes you have a smaller number of coins, but think how many are not even reading this advice, much less acting on it! Buy, and do it now. And only with funds that you can afford to lose. If you buy, and it crashes, but you have gained more determination that it is a good thing in the meanwhile, you can buy more.

When the plan is underway, and it crashes, I don’t advice to buy

back. Enjoy your rake rather. Bitcoin may continue to go down,

you don’t know it. Even if it goes to zero, you will have

gained. If you need to pay taxes on the realized gains (as most

of us do), it makes even less sense to go in and out.

If you want to daytrade, do it entirely separate from this, so

that your daytrading has no effect on the execution of SSS plan

and vice versa. In the end you will see, which one was more

profitable and better use of time.

It is possible to make the selling effectively continuous,

instead of discrete. You just send 10% of your coins to an

exchange and divide the next doubling to small enough increments

(say, 10 of them) and list your coins for sale. This way you get

to sell every time the price rises to a new ATH. Because ATH’s

happen on times when Bitcoin is ahead of the trend, the timing

of the selling is better than average.

It is entirely your own decision, how to allocate the

non-bitcoin portfolio. Local differences dictate the prudent

course of action. I have in the past tried to keep all forks of

Bitcoin equally but choosing which one to focus on is an

exercise left to the reader.

Thank you, and don’t forget rule number one, buy Bitcoin :)